A major shift is coming for European booking agencies and artist management teams: starting in 2026, many EU countries will require mandatory digital e-invoicing for small and medium-sized enterprises (SMEs). This is part of the EU’s VAT in the Digital Age (ViDA) initiative, aimed at making VAT reporting more accurate, real-time, and standardised across borders.

For agencies using Overture’s booking management software, this means preparing your invoicing workflows for compliance with country-specific e-invoice standards. That’s why we’re integrating XML e-invoice support directly into Overture so you can issue legally compliant invoices effortlessly, reduce admin work, and keep your artist bookings and financial documents in perfect sync.

Why This Matters

- Countries such as Belgium, Poland, France, Germany, and others are phasing in mandates requiring structured XML-based e-invoices (often following EN 16931 standards or using platforms like Peppol, Factur-X, or national schemas) starting in 2026.

- Late adoption could interrupt your billing workflow, delay VAT reporting, or even trigger penalties.

- XML e-invoices are more than a regulatory requirement, they enable automation, faster processing, and easier cross-border compliance.

How Overture Will Support Your Compliance

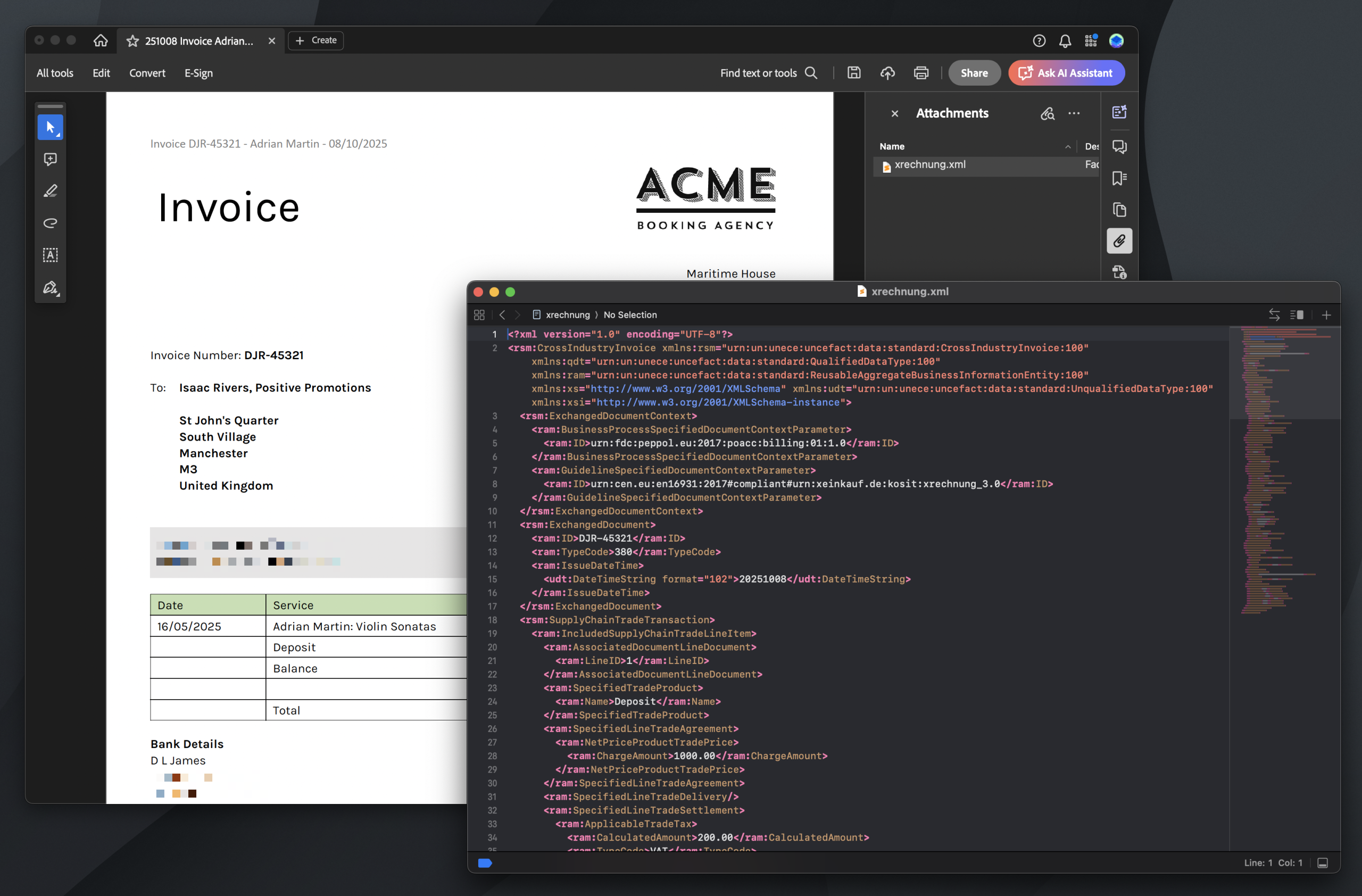

From 2026 onward, when your account is configured for XML e-invoicing, every invoice you generate in Overture can automatically produce:

- A standard PDF invoice (legacy friendly)

- A digitally structured XML version that matches the required format of your country or trading partner

- These XML invoices will be ready to download, send, or integrate with national tax portals and accounting systems.

User Flow in Overture

- Enable XML E-Invoicing in your account settings – Overture activates XML export for invoices

- Create a new invoice in the usual way – Overture generates both a PDF and matching XML file

- Review invoice XML file – appears alongside PDF in the invoice record

- Send invoice – Option to deliver via API, email, or download for upload to local portal

- Submit for tax reporting or compliance – XML file is structured and EN 16931-compatible, ready for national or EDI platforms

Why Overture’s Approach Works for You

- Built-in Compliance – no need for separate e-invoicing software or manual conversions

- Seamless Experience – you keep creating invoices the same way, but now you produce compliant output as well

- Scalable – supports multiple country schemas and evolving mandates under ViDA

- Future Ready – aligns with EU’s move toward structured, real-time digital tax reporting

What You Can Do Now

- Review upcoming mandates in key EU markets (Belgium, France, Poland, Germany, etc.) to map required deadlines.

- Prepare your account – update your agency’s billing settings in Overture with your country and VAT details.

- Test the workflow with sample invoices before you go live.

- Stay informed — receive alerts in the Overture Newsletter when regional XML e-invoicing becomes available and mandatory.

The move to XML e-invoices isn’t just a compliance task, it’s a leap toward modern, digital-first agency finance. Overture’s upcoming feature ensures you’re not only ready for the rules but better equipped to run efficiently, smoothly, and globally.

Let us know if you’d like help planning this transition, or if you want early access to the XML invoicing feature for testing.